ShapeShift decentralizes with an airdrop, the FBI warns about crypto and Square builds a DeFi platform for Bitcoin. These stories and more this week in crypto.

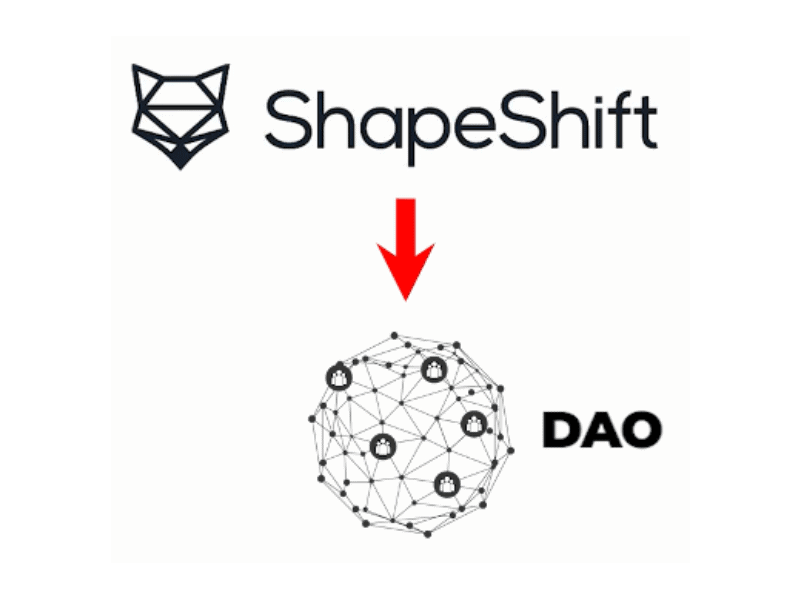

Crypto trading pioneer ShapeShift is closing its doors, handing over its legacy to a decentralized autonomous organization (DAO) controlled by holders of its FOX token. Former employees and past users will receive tokens in an airdrop. ShapeShift is winding down as a formal company and will have no employees, no bank accounts and no CEO within a year’s time.

The FBI has issued a warning to U.S. residents about cryptocurrency. The government agency explained to traders that since last year, the level of crypto-focused fraud has increased tenfold, and thus digital assets should be avoided unless one knows how to fully defend themselves against inherent risks.

Popular mobile payments platform Square, is branching out with a new DeFi business venture. It will host a platform for developers to create non-custodial and decentralized financial projects built specifically around Bitcoin. Dorsey added that the project will be completely open-source, just like Square’s recently announced new Bitcoin hardware wallet.

Binance’s highly popular stock tokens, a relatively recent offering, are being wound down. In an announcement published on Friday, the exchange announced that “effective immediately,” stock tokens are unavailable for purchase on Binance.com. Users who currently hold stock tokens may sell or hold them over the next 90 days.

Customers looking to purchase more cryptocurrency through PayPal may now do so as the digital payments giant has increased clients’ crypto-purchasing allotment to $100,000 per week. Prior to the change, users were only allowed to purchase up to $20,000 in crypto every seven days. PayPal first announced that it would bring crypto services to its customers in October 2020.

Fidelity Digital Assets is planning to increase headcount by 70% as demand for cryptocurrency from institutional investors remains strong. The new employees will develop new products and expand the business into cryptocurrencies besides Bitcoin. As institutional interest in Ether has been growing rapidly this year, the company is now looking to offer ETH in the future.

Ukrainian authorities raided what appeared to be an abandoned warehouse that was full of PS4s hooked up to illegally mine bitcoin and other cryptocurrencies. As many as 3800 gaming consoles have all been confiscated, though the fraudsters are alleged to have stolen nearly $200,000 worth of electricity from nearby residents.

Police in the U.K. have shut down an illicit money laundering scheme in London that allegedly held nearly $250 million in bitcoin. The Metropolitan Police force issued a statement saying that it was the largest cryptocurrency seizure in the country’s history and likely one of the largest in the world.

That’s what’s happened this week in crypto, see you next week.