In the 21st century, earning from multiple jobs is becoming trendy and might become the norm as well. With globalization and localization intermixing in almost every nation across the world, and cryptocurrencies becoming popular daily, investing and earning from crypto holdings is being imbibed by a large proportion of the population. Crypto holdings could be perceived as digitalized, decentralized, and updated version of Stock Exchanges. As this model/version is upgraded, the Return-on-Investment (ROI) increases exponentially, but so does the risk. As Decentralized Finance (DeFI) functions on an open-source platform along with decentralized applications like smart contracts and alike, the benefits may vary depending on multiple factors which may alter on an ad-hoc basis. In crux, this piece will offer a few ways of earning incoming borrowing and lending digital-crypto currencies.

There are a couple of platforms where Bitcoin (BTC) owners could generate passive income by converting their BTC into Ethereum (ETH) or a stable coin like DAI, and then lend it via a platform/s where tokens could earn interest. Some of them include:

MakerDAO – It allows its users to obtain its stable-coin, “Dai” through locking up their Ethereum. The maker protocol uses a 2-token system. The first being, Dai- a collateral-backed stablecoin that provides stability. The philosophy here is that a decentralized stable coin is required to have a business/individual realize numerous advantages of digital money. The second being, MKR- a governance token that is utilized by stakeholders to maintain the system and manage Dai.

Aave – It’s a decentralized non-custodial money market protocol where users have the option of participating as borrowers or depositors. Depositors offer liquidity in the market to earn a passive income, while borrowers can borrow in a perpetually, one-block liquidity manner. A pool-based strategy is being employed where lenders provide liquidity by depositing Ether tokens in a pool contract. Doing so makes it possible to earn interest or employ the funds transmitted as collateral for borrowing an asset.

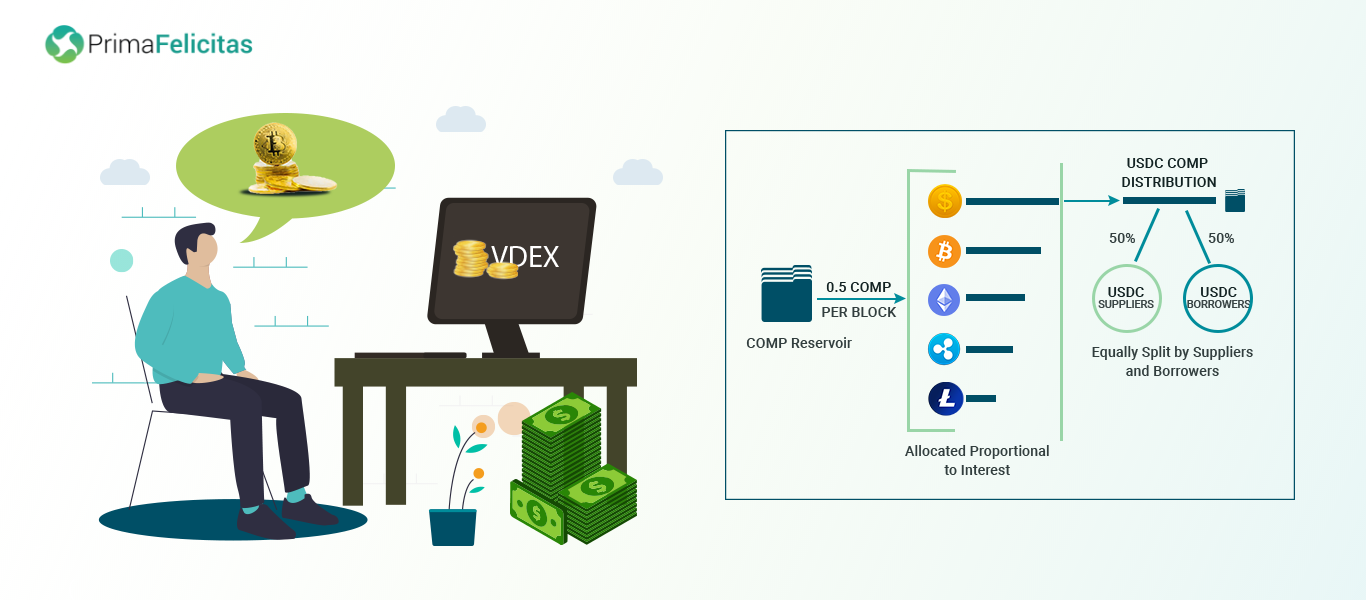

Compound – It utilizes a similar model like Aave, but it has a distinct reward mechanism that has led to the creation of yield farming, where Governance tokens are rewarded to borrowers and lenders besides the given interest. The Compound is a protocol which established money markets that are pools of assets with algorithmically derived interest rates based on the supply and demand of the asset.

As one could see in the above infographic (right side), that Compound (COMP Reservoir) is offering liquidity mining for liquidity providers, which means that borrows or supplies assets will be rewarded with a proportional allocation of the COMP.

A risk-factor which once should keep in mind while investing in Crypto Holdings (as mentioned by Andreas Antonopoulos) is that of concerning security. The reason for saying so is that as the blockchain ecosystem, and DeFI platform is still in its early phase, there are instances where smart contracts get bugs along with them as well. Besides that, there’s a risk of theft or mismanagement as well. Having said so, if one opts an appropriate platform and proactively scrutinizes every step of the process, such risks would not be able to reach you.