Bananarama may have sung about a cruel summer, but November is turning out to be no great shakes for cryptocurrency investors, either. There are just six weeks left in 2021 and the CoinDesk Bitcoin Price Index (XBX) dipped nearly 20% off an all-time high set Nov. 10.

Yet there’s something interesting in one thing going in the markets right now: leverage. Or, rather, the recent drop-off in demand for it.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Sunday.

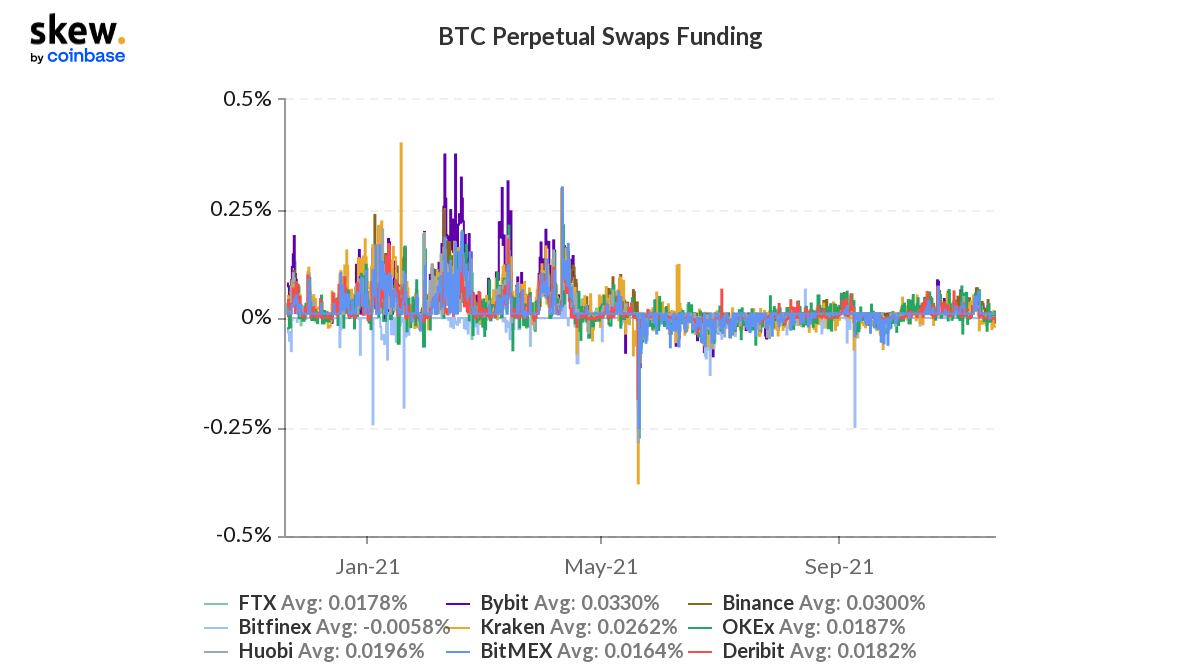

After May’s miserable selloff, the demand for borrowing money to go long on crypto took a hit as well. Bitcoin perpetual swaps funding rates – that is, the cost of holding a levered long position in the most liquid offshore derivatives markets – stayed largely negative through the end of July.

As prices began testing the $40,000 level at the end of July, funding rates began to tick up, and the market for perpetual swaps and futures grew. On Aug. 22, the combined open interest in bitcoin futures on BitMEX, Binance, Bybit, OKEx and Huobi broke above $10.4 billion, more than 50% higher than it was 90 days before, just after the May crash. Over the same period, the bitcoin spot price rose by about 30%.

After the spot market peak of $68,990.90 on Nov. 10 (per the XBX), prices fell and the funding rate plunged. Open interest did not. Between Nov. 10 and Nov. 18, aggregate open interest on bitcoin perp swaps and futures fell from $24.9 billion to $22.8 billion, according to Skew – about 8%, far less than the spot-market price drop over the same period. Compare that to the September dip (another drop of around 20% in the spot price). At that time, open interest fell 33% between the local high on Sept. 6 and the bottom on Sept. 27.

So it could be that the latest decline in bitcoin prices may be due not to deleveraging so much as just a lack of demand for leveraged-long positions.

“The balance on futures exchanges is decreasing (fewer collaterals) while open interest remains very high,” said data provider CryptoQuant’s CEO Ki Young Ju to CoinDesk. “There’s no cascade of short liquidations for now. I think the market is likely to go sideways in a broad range to cool off the futures market for the next few days.”

Options traders seem to agree: One-week at-the-money implied volatility in the bitcoin options market, at roughly 73%, is falling toward the rising 10-day realized volatility of 70%, noted Genesis Global Trading in a recent market comment. That’s a sign that the market doesn’t expect anything extraordinary – at least, not by crypto market norms.

Some see bullish signals in the market for leverage. “A reduction in leverage smooths volatility,” Marc LoPresti, The Strategic Funds managing director, said on CoinDesk TV’s “First Mover” program on Nov. 18, amid a market lull. “That’s a good thing not only for institutional [investors] but for retail holders as well. I think that pattern will continue as we see less leverage usage … we’re going to see continued upside.”

Still, it hasn’t exactly plummeted. It’s still around where we were a month ago and well above what we saw over the summer. It’s been a fairly orderly decline over the past few days.

Lower rates may entice bitcoin bulls to place levered bets on a rally, but there’s still the threat of a sudden price move, bringing about another round of large liquidations.

In other words, to borrow from Hemingway, a fall in bitcoin price may happen gradually, then suddenly.